Reconcilation Engine

Automated Reconciliation

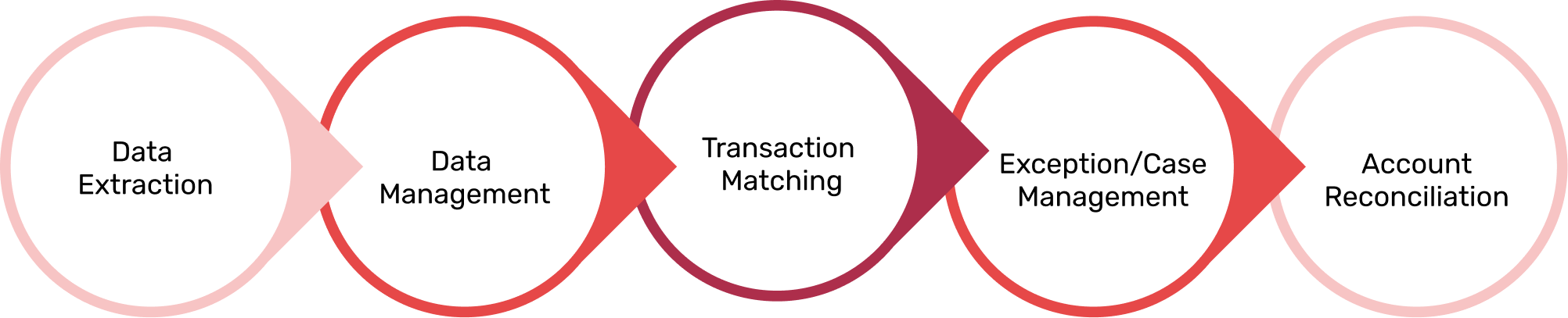

In the digital era, the landscape of reconciliation is undergoing a transformative shift through automated systems. Automated reconciliation tools leverage

- Advanced algorithms

- Data-matching techniques

Swiftly compares large datasets, identifies discrepancies, and highlights exceptions. This not only significantly reduces the risk of errors but also enhances the efficiency of the reconciliation process.